Creative Giving

How do you determine the best way to give so your gift goes as far as possible and has maximum impact? There are a variety of options to help you support Thornapple Covenant Church in impactful, creative and tax-savvy ways. Learn more HERE.

Maximize Your Giving

This guide for givers has solutions and strategies to help you make the most of your resources.

(click image to download)

Stock Gifts

Gifts of securities can be a strategically effective way to support Thornapple. Tim Frazier is our financial services representative with Covenant Trust Company who can facilitate the process.

IRAs

Tax-free gifts to qualified charities can be made directly from your IRA. A qualified charitable distribution (QCD) allows an IRA holder to send a donation directly to a public charity, and not have the distribution included on your tax return as ordinary income. A QCD allows individual taxpayers 70½ years of age or older to donate up to $100,000 per year to eligible charities including colleges, universities, independent private schools, and ministries from their traditional IRA tax-free.* This donation goes straight from the IRA to the charity. For traditional IRA owners who must take a required minimum distribution (RMD) from their IRA each year, the QCD provision is an opportunity to meet the RMD requirement while minimizing the effect on their taxable income.

*Qualified charitable distributions are not available for 401(k) or Roth IRA accounts.

*Qualified charitable distributions are not available for 401(k) or Roth IRA accounts.

Donor-Advised Fund

Many families find that a Donor-Advised Fund (DAF) is an excellent alternative to a private family foundation because it offers a uniquely flexible way to address an individual’s or family’s charitable interests over both the short and long term. By establishing such a fund, you can time the gifts you make (for investment or tax reasons) and you can select the charities you wish to benefit from your gifts. Plus, you receive the income or estate tax deduction, and the opportunity is there to make distribution decisions later. Learn more HERE.

Thornapple is a generous church.

We have been thoroughly blessed by both the generosity of our congregation – both of their time and their financial resources.

Give Online

Why we give.

We give because we have received. Not just tangible resources, but blessings of all kinds.

Everyone knows what it means to be generous. Some people are generous because they get something in return such as access to privilege or perks that others don’t have. That isn’t why we give back to God. We are not seeking a return we are giving in return for what we have received.

What you possess you have received from God’s gracious hand. We express our thanks, our praise and our worship by giving a part of what we have back to God in the use of His Kingdom. That includes the many ministries of Thornapple. Without the gifts of those who are part of this church there would be no church or its many ministries. We give out of love, in thanks, in honor to God, and to know that because God has given to us, we have given back to Him through our church.

What you possess you have received from God’s gracious hand. We express our thanks, our praise and our worship by giving a part of what we have back to God in the use of His Kingdom. That includes the many ministries of Thornapple. Without the gifts of those who are part of this church there would be no church or its many ministries. We give out of love, in thanks, in honor to God, and to know that because God has given to us, we have given back to Him through our church.

Stewardship: Being thoughtful and responsible with what God has given us.

Most people you talk to won’t even know what the word “stewardship” means. Technically, it simply means taking care of something that doesn’t belong to us. It implies careful and intentional management of something important. Essentially everything belongs to God, but He has given us the tasks of stewarding everything. That most directly applies to our time, talents and treasures.

Many see the word “tithe” but aren’t sure what it means.

The Old Testament makes clear that God’s people are to return to God the first 10% of what He provides them.

For Christ’s followers at Thornapple, the amount of your giving is a personal matter for you to prayerfully consider, always giving first to God with a heart of generosity. God calls us to be generous with what He has given, and the tithe is a good place to start. Our offerings above and beyond that are an opportunity to rejoice in abundance and gratitude for all that God has done, and is doing, in our lives.

For Christ’s followers at Thornapple, the amount of your giving is a personal matter for you to prayerfully consider, always giving first to God with a heart of generosity. God calls us to be generous with what He has given, and the tithe is a good place to start. Our offerings above and beyond that are an opportunity to rejoice in abundance and gratitude for all that God has done, and is doing, in our lives.

Each of you should give what

you have decided in your heart to give,

not reluctantly or under compulsion,

for God loves a cheerful giver.

2 CORinthians 9:7

Ways To Give

When you stop and think about it, there are so many ways to give back to God. Here are a few.

Tithes and offerings used to only be with cash or check in an offering plate or in an envelope. Now, the options for giving are immense. Not only can you give with cash or check, you can give online through a checking account or credit card, and you can do so via your computer, tablet or smartphone.

But it doesn’t stop there. Did you know you might save on taxes and protect more of your assets by giving directly from retirement accounts or other investments? Or, have you considered what a gift much later from your estate might mean as part of your stewardship and how that too can save your heirs from significant taxes on their inheritance? To learn more, check out the Planned Giving and Estate Planning sections.

Here are more procedural details for the various ways to give.

But it doesn’t stop there. Did you know you might save on taxes and protect more of your assets by giving directly from retirement accounts or other investments? Or, have you considered what a gift much later from your estate might mean as part of your stewardship and how that too can save your heirs from significant taxes on their inheritance? To learn more, check out the Planned Giving and Estate Planning sections.

Here are more procedural details for the various ways to give.

Digital/Online Giving

Digital giving is easy, safe, secure and can be either recurring or as needed. Go here to set up your digital gifts via checking account, debit card or credit card. If you have any questions, please contact Kimberly Korpak (616.818.0526).

Bill Pay

Through your financial institution’s bill pay program, you may make Thornapple Covenant Church a payee, just as you would for a utility provider. The financial institution will generate a check and mail it to Thornapple, usually arriving within a week’s time.

Check and Cash

Giving the “tried and true” way still works, either in person or by mail. Cash and checks will be received at the Welcome Center desk in the “Offering” box. Mailed contributions can be sent to: Thornapple Covenant Church (Attn: Staff Accountant), 6595 Cascade Rd. SE, Grand Rapids, MI 49546

Planning Giving

Current or future gifts and may be set up with or without the help of Thornapple staff and/or advisors. These ways of giving various types of assets can be arranged with your advisors in finance, investments, or insurance. More information is available by emailing a request for assistance.

planned giving

Making a planned gift can be for both now and later. A little planning can make a lot of difference.

The now of a planned gift can mean gifts originating from sources other than cash, checks and current liquid assets so that your resources are better managed for both tax benefits and planned benefits for you and for family, heirs, ministries and your estate.

A planned gift now can involve appreciated assets, required distributions from retirement accounts, taxable gain on the sale or maturing of assets, and other sources of funds that might well benefit the Kingdom and save you from unnecessary taxes.

A planned gift later addresses how your generosity can be planned and documented to make a difference for Thornapple as well as you and your heirs. Many stewards use the sale of maturing assets, such as selling a home or business, a maturing investment – even giving appreciated assets rather than using current assets to make a charitable gift. If desired, equivalent amount of cash/current value assets can be used to rebuy the same stock/investment and avoid the capital gain.

External national and local resources are available through Thornapple, and the Covenant denomination, to provide information and guidance for both financial and legal/estate aspects of these gifts. You can be good to your family/heirs as well as generous to God’s work on earth through what God has provided… it just takes a little planning.

Online and printed materials are available through Thornapple, as well as through financial and legal advisors, to begin to address your questions and needs. Contact us with questions or if we can connect you with others who may help.

A planned gift now can involve appreciated assets, required distributions from retirement accounts, taxable gain on the sale or maturing of assets, and other sources of funds that might well benefit the Kingdom and save you from unnecessary taxes.

A planned gift later addresses how your generosity can be planned and documented to make a difference for Thornapple as well as you and your heirs. Many stewards use the sale of maturing assets, such as selling a home or business, a maturing investment – even giving appreciated assets rather than using current assets to make a charitable gift. If desired, equivalent amount of cash/current value assets can be used to rebuy the same stock/investment and avoid the capital gain.

External national and local resources are available through Thornapple, and the Covenant denomination, to provide information and guidance for both financial and legal/estate aspects of these gifts. You can be good to your family/heirs as well as generous to God’s work on earth through what God has provided… it just takes a little planning.

Online and printed materials are available through Thornapple, as well as through financial and legal advisors, to begin to address your questions and needs. Contact us with questions or if we can connect you with others who may help.

Estate Planning

An estate plan (a will or trust) is a wonderful tool for you and your heirs. It is also one of the easiest things to postpone—unfortunately.

Generally speaking, having your plans and desires identified in a will or a trust is one of the best gifts you can provide to family and other heirs. Without it, the burden can be rather hard to bear for those left to manage your affairs.

Estate planning is about more than just wills and trusts. It also involves beneficiary designations on assets in retirement accounts, as well as including real estate, personal property and other investments. Many of these tools are readily available online and the tasks are often easily addressed.

But if your estate plans still need a will or a trust, or if yours needs updating, we have local and national resources we can connect you with outside of the church – if you don’t have somewhere else to turn.

Contact us with questions or if we can connect you with others who may help.

Estate planning is about more than just wills and trusts. It also involves beneficiary designations on assets in retirement accounts, as well as including real estate, personal property and other investments. Many of these tools are readily available online and the tasks are often easily addressed.

But if your estate plans still need a will or a trust, or if yours needs updating, we have local and national resources we can connect you with outside of the church – if you don’t have somewhere else to turn.

Contact us with questions or if we can connect you with others who may help.

Thornapple is a generous church.

We have been thoroughly blessed by both the generosity of our congregation – both of their time and their financial resources.

Year-End Giving

How do you determine the best way to give so your gift goes as far as possible and has maximum impact? There are a variety of options to help you support Thornapple Covenant Church in impactful, creative and tax-savvy ways.

Learn more HERE.

Learn more HERE.

Maximize Your Giving

This guide for givers has solutions and strategies to help you make the most of your resources.

(click image to download)

Stock Gifts

Gifts of securities can be a strategically effective way to support Thornapple. Tim Frazier is our financial services representative with Covenant Trust Company who can facilitate the process.

IRAs

Tax-free gifts to qualified charities can be made directly from your IRA. A qualified charitable distribution (QCD) allows an IRA holder to send a donation directly to a public charity, and not have the distribution included on your tax return as ordinary income. A QCD allows individual taxpayers 70½ years of age or older to donate up to $100,000 per year to eligible charities including colleges, universities, independent private schools, and ministries from their traditional IRA tax-free.* This donation goes straight from the IRA to the charity. For traditional IRA owners who must take a required minimum distribution (RMD) from their IRA each year, the QCD provision is an opportunity to meet the RMD requirement while minimizing the effect on their taxable income. A qualified charitable distribution is a great way to positively affect your tax situation while also helping you achieve your charitable goals. Give us a call, we’d be happy to show you how.

*Qualified charitable distributions are not available for 401(k) or Roth IRA accounts.

Donor-Advised Funds

Many families find that a Donor-Advised Fund (DAF) is an excellent alternative to a private family foundation because it offers a uniquely flexible way to address an individual’s or family’s charitable interests over both the short and long term. By establishing such a fund, you can time the gifts you make (for investment or tax reasons) and you can select the charities you wish to benefit from your gifts. Plus, you receive the income or estate tax deduction, and the opportunity is there to make distribution decisions later. Learn more HERE.

Gifts of securities can be a strategically effective way to support Thornapple. Tim Frazier is our financial services representative with Covenant Trust Company who can facilitate the process.

IRAs

Tax-free gifts to qualified charities can be made directly from your IRA. A qualified charitable distribution (QCD) allows an IRA holder to send a donation directly to a public charity, and not have the distribution included on your tax return as ordinary income. A QCD allows individual taxpayers 70½ years of age or older to donate up to $100,000 per year to eligible charities including colleges, universities, independent private schools, and ministries from their traditional IRA tax-free.* This donation goes straight from the IRA to the charity. For traditional IRA owners who must take a required minimum distribution (RMD) from their IRA each year, the QCD provision is an opportunity to meet the RMD requirement while minimizing the effect on their taxable income. A qualified charitable distribution is a great way to positively affect your tax situation while also helping you achieve your charitable goals. Give us a call, we’d be happy to show you how.

*Qualified charitable distributions are not available for 401(k) or Roth IRA accounts.

Donor-Advised Funds

Many families find that a Donor-Advised Fund (DAF) is an excellent alternative to a private family foundation because it offers a uniquely flexible way to address an individual’s or family’s charitable interests over both the short and long term. By establishing such a fund, you can time the gifts you make (for investment or tax reasons) and you can select the charities you wish to benefit from your gifts. Plus, you receive the income or estate tax deduction, and the opportunity is there to make distribution decisions later. Learn more HERE.

Why we give.

We give because we have received. Not just tangible resources, but blessings of all kinds.

Everyone knows what it means to be generous. Some people are generous because they get something in return such as access to privilege or perks that others don’t have. That isn’t why we give back to God. We are not seeking a return we are giving in return for what we have received.

What you possess you have received from God’s gracious hand. We express our thanks, our praise and our worship by giving a part of what we have back to God in the use of His Kingdom. That includes the many ministries of Thornapple. Without the gifts of those who are part of this church there would be no church or its many ministries. We give out of love, in thanks, in honor to God, and to know that because God has given to us, we have given back to Him through our church.

What you possess you have received from God’s gracious hand. We express our thanks, our praise and our worship by giving a part of what we have back to God in the use of His Kingdom. That includes the many ministries of Thornapple. Without the gifts of those who are part of this church there would be no church or its many ministries. We give out of love, in thanks, in honor to God, and to know that because God has given to us, we have given back to Him through our church.

Stewardship

Being thoughtful and responsible with what God has given us.

Most people you talk to won’t even know what the word “stewardship” means. Technically, it simply means taking care of something that doesn’t belong to us. It implies careful and intentional management of something important. Essentially everything belongs to God, but He has given us the tasks of stewarding everything. That most directly applies to our time, talents and treasures.

Each of you should give what you have decided in your heart to give,

not reluctantly or under compulsion, for God loves a cheerful giver.

2 COR. 9:7

Tithe

Many see the word “tithe” but aren’t sure what it means.

The Old Testament makes clear that God’s people are to return to God the first 10% of what He provides them.

For Christ’s followers at Thornapple, the amount of your giving is a personal matter for you to prayerfully consider, always giving first to God with a heart of generosity. God calls us to be generous with what He has given, and the tithe is a good place to start. Our offerings above and beyond that are an opportunity to rejoice in abundance and gratitude for all that God has done, and is doing, in our lives.

For Christ’s followers at Thornapple, the amount of your giving is a personal matter for you to prayerfully consider, always giving first to God with a heart of generosity. God calls us to be generous with what He has given, and the tithe is a good place to start. Our offerings above and beyond that are an opportunity to rejoice in abundance and gratitude for all that God has done, and is doing, in our lives.

A tithe of everything from the land,

whether grain from the soil or fruit from the trees,

belongs to the Lord; it is holy to the Lord.

Leviticus 27:30

Ways To Give

When you stop and think about it, there are so many ways to give back to God. Here are a few.

Tithes and offerings used to only be with cash or check in an offering plate or in an envelope. Now, the options for giving are immense. You can give today - digitally or otherwise - and in the future through planned giving and estate planning.

Procedural details for the various ways to give.

Procedural details for the various ways to give.

Digital/Online Giving

Digital giving is easy, safe, secure and can be either recurring or as needed. Go here to set up your digital gifts. If you have any questions, please contact Kimberly Korpak (616.818.0526).

Bill Pay

Through your financial institution’s bill pay program, you may make Thornapple Covenant Church a payee, just as you would for a utility provider.

Check and Cash

Giving the “tried and true” way still works, either in person or by mail.

Planning Giving

Current or future gifts and may be set up with or without the help of Thornapple staff and/or advisors. These ways of giving various types of assets can be arranged with your advisors in finance, investments, or insurance. More information is available by emailing a request for assistance.

planned giving

Making a planned gift can be for both now and later. A little planning can make a lot of difference.

The now of a planned gift can mean gifts originating from sources other than cash, checks and current liquid assets so that your resources are better managed for both tax benefits and planned benefits for you and for family, heirs, ministries and your estate.

A planned gift now can involve appreciated assets, required distributions from retirement accounts, taxable gain on the sale or maturing of assets, and other sources of funds that might well benefit the Kingdom and save you from unnecessary taxes.

A planned gift later addresses how your generosity can be planned and documented to make a difference for Thornapple as well as you and your heirs. Many stewards use the sale of maturing assets, such as selling a home or business, a maturing investment – even giving appreciated assets rather than using current assets to make a charitable gift. If desired, equivalent amount of cash/current value assets can be used to rebuy the same stock/investment and avoid the capital gain.

Online and printed materials are available through Thornapple, as well as through financial and legal advisors, to begin to address your questions and needs. Contact us with questions or if we can connect you with others who may help.

A planned gift now can involve appreciated assets, required distributions from retirement accounts, taxable gain on the sale or maturing of assets, and other sources of funds that might well benefit the Kingdom and save you from unnecessary taxes.

A planned gift later addresses how your generosity can be planned and documented to make a difference for Thornapple as well as you and your heirs. Many stewards use the sale of maturing assets, such as selling a home or business, a maturing investment – even giving appreciated assets rather than using current assets to make a charitable gift. If desired, equivalent amount of cash/current value assets can be used to rebuy the same stock/investment and avoid the capital gain.

Online and printed materials are available through Thornapple, as well as through financial and legal advisors, to begin to address your questions and needs. Contact us with questions or if we can connect you with others who may help.

Estate Planning

An estate plan (a will or trust) is a wonderful tool for you and your heirs. It is also one of the easiest things to postpone—unfortunately.

Generally speaking, having your plans and desires identified in a will or a trust is one of the best gifts you can provide to family and other heirs. Without it, the burden can be rather hard to bear for those left to manage your affairs.

Estate planning is about more than just wills and trusts. It also involves beneficiary designations on assets in retirement accounts, as well as including real estate, personal property and other investments. Many of these tools are readily available online and the tasks are often easily addressed.

But if your estate plans still need a will or a trust, or if yours needs updating, we have local and national resources we can connect you with outside of the church – if you don’t have somewhere else to turn.

Contact us with questions or if we can connect you with others who may help.

Estate planning is about more than just wills and trusts. It also involves beneficiary designations on assets in retirement accounts, as well as including real estate, personal property and other investments. Many of these tools are readily available online and the tasks are often easily addressed.

But if your estate plans still need a will or a trust, or if yours needs updating, we have local and national resources we can connect you with outside of the church – if you don’t have somewhere else to turn.

Contact us with questions or if we can connect you with others who may help.

Stories

Our lives are our story. Stories tell something about who we are becoming as well as who we have been.

We’d love to hear your story that might be an encouragement to others and a way for you to give praise to God. If you have some thoughts to share about your decisions and action to be generous and give back to God, please contact the Generosity Team. Let’s encourage others and give praise and honor to God for what we have learned and acted upon.

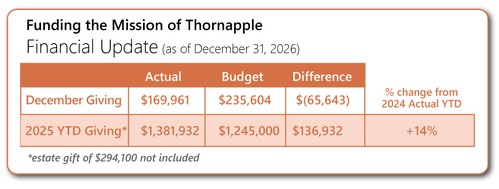

Financial Update

While our December giving fell below budget, our total year-to-date giving surpassed the budget and for that we are so thankful! Thank you for your generosity in 2025 and we pray for God's continued provision in 2026.

Thank you for your faithful support of the ministry of Thornapple Covenant Church.

If you have questions, contact Kimberly Korpak.

Please remember that all donations to Thornapple are kept confidential.

For where your treasure is,

there your heart will be also.

- Matthew 6:21